Payment Gateway is a payment solution for websites. This is like a bridge that facilitates the transaction of money from the customer to the business. Payment Gateway is the middleman between the customer and the business that collect customer money and transfer to the bank account of the merchant. Since the payment gateway is dealing with a lot of sensitive information the payment gateway has to keep their channel secure and encrypted. Having said that, a payment gateway is used by many websites who accept payment and all the e-commerce websites. The e-commerce website major way of paying money is by accepting money through a payment gateway.

How does payment gateway work?

Payment Gateway has a very secure and encrypted data channel that makes sure the user, as well as the merchant data, is fully secure and no chance of any hacker to steal the precious data. This gateway of payment is secured by multi-level encryption like PCI-DSS, Norton security etc.

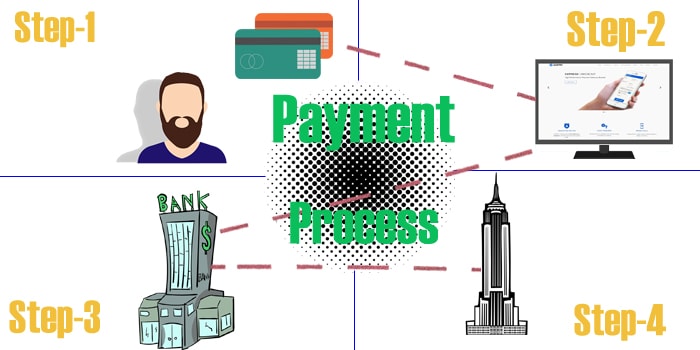

Step-1: The payment process starts by choosing the payment option you want to consider for paying in regards to the service you are buying. There are three ways to consider if you are paying money online namely Net banking, Debit/Credit card and E-wallet.

Step-2: Payment gateway works in two different ways. First, it collects the information from the website the payment is initiating in encrypted data packets or the website will redirect to the payment gateway’s website and the information is inserted there by the customer. When considering this one should always keep in mind that only the trustworthy website is allowed to send the encrypted data packets to the payment gateway website. For the small businesses or new startup always utilizes the payment gateway’s website for money transaction.

Step-3: The information the payment gateway collected from the customer is then transferred to the customer’s bank account to initiate the money is then transferred to the payment gateway and then the confirmation message of the credit of the money is sent by the bank to your Registered Mobile Number (RMN).

Step-4: Now, the payment gateway holds the money for sometimes depending upon their terms and condition for the service and then transfers the money to the company’s current bank account. The payment gateway provides the company with a unique id that helps the company in tracking their money transfer.

This initial payment process is initiated in just 3 seconds followed by the holding period as per the payments gateway terms and then the company receives the money in their bank account.

Why Payment Gateway is Better Than Traditional Payment Methods?

There are a various method of payment that our banking system offers. In this digital age, everyone prefers fund transfer via online. The traditional payment option includes Cheque, DD, Net Banking, NEFT etc. these methods are used by everyone but this system of banking is best for fund transfer to some beneficiary account or the people we know. In an online business, we do not have a face to face interaction. The customer visits the website in need of a product and buys it. There is no direct marketing involved with online method. The traditional method of fund transfer involves adding a beneficiary to your account and then transferring money or collecting the Cheque physically. Also, you need a lot of information like company bank account number, IFSC Codes etc. This makes this process time-consuming process and makes a problem for the customer. Payment gateway saves us form this processes and make online money transfer a simple few clicks process. In the above paragraph, I have mentioned the process of money transfer. This does not require anything apart from the card details or net banking details that everyone holds with them.

Payment Gateway Charges

The charges of the payment gateway depend on the various factors and contain per transaction commission form the company side. These charges are only applicable to the company and the customer does not have to pay any service fee to the payment gateway. The following are the cost that payment gateway charges-

Setup Cost

There is an initial setup cost involves in the process and the payment gateways charge money from the company but in recent few years, this cost has vanished due to a very competitive market, the payment gateways offer no setup cost for a regular startup setup.

Annual Maintenance Fee

There are software, server and the proactive team involved so the annual maintenance charges are charged by the payments gateway form the company. The amount of annual maintenance fee charged depends on the payments gateway and usually provided free now a days.

Transaction Charges

A certain percentage of the amount is charged on each transaction by the payment gateway from the company and this charges usually consist of 1-5% depends on the payment gateway.

Is payment gateway is secure?

The payment gateway is a very secure process of paying money. The data that the customer inputs for making the transaction are encrypted to prevent any third party from entering in between the transaction. The encryption system is like a lock and key, the information that your inputs are collected in a packet form. These packets are then sent to the receiver end but before the packets are released from the sender the packets are encrypted means locked with a specific key. Cracking this key from an expert hacker require millions of years because this encryption is in a hash format which is very tough to crack even by a supercomputer. Along the process of the data transfer, there is multi-level encryption involved in the process. So, it is impossible for a third party to enter the transaction. But you still hear a lot about the hacker hacking account and stealing money. This type of cases usually is manual errors. When a person inputs his details then it is venerable to the data stealers like keyloggers, over the shoulder look etc. To prevent this from happening the customer needs to keep his data to himself only and should always check the website authenticity along.

Popular Payment Gateway

Some of the most popular Payments Gateways are-

- CCAvenue

- EBS

- Paytm

- Citrus Pay

- DirecPay

- Atom

- Zaakpay

- PayUmoney

- HDFC Payment Gateway Services

- ICICI Payseal

- PayUbiz

- Whizpay

- Razorpay

Payment Gateway is a fortune for the businesses as this enables the business to save the time and effort of the customer. This is secure and an easy way of doing business. The psychology says, that if you reduce the steps of the customer in making the transaction then the business deal you are about to crack will become successful. You must have noticed that all the e-commerce website saves your card details to make the payment faster. This creates a trigger in customers psyche and he will buy that product.

I am Sunil Tarwara, a seasoned IT professional with over 13 years of hands-on experience in Website Development and Digital Marketing. With a deep understanding of the challenges faced by businesses, I have been trusted by hundreds of clients to achieve their digital goals. I have Master’s degree in Information Technology.

Apart from websites, I like hill stations.